The Pennant Pattern and Bitcoin's Breakthrough

A symmetrical triangle, also known as a pennant pattern, has recently been observed forming just below the pivotal $30,000 resistance level for Bitcoin. This pattern is identified by two converging trend lines as the price consolidates before potentially breaking out. According to market analyst Jesse Colombo, if Bitcoin manages to break free from this pattern and exceed the $30,000 mark with significant trading volume, it would signal a bullish confirmation for the cryptocurrency. This development could trigger a new uptrend as buying pressure intensifies.

Significance of the $30,000 Resistance Level

In a subsequent tweet, Colombo emphasized the importance of the $30,000 resistance level, pointing to the weekly Bitcoin chart. This chart demonstrates how vital this resistance point is in determining the future path of Bitcoin's price. The $30,000 resistance level has attracted the attention of traders and investors as it has consistently acted as a formidable barrier to price fluctuations. Breaching this level successfully could suggest further gains, with potential targets at $35,000 and $40,000.

Investment Strategy: Gold, Silver, and Bitcoin

Colombo also discussed his investment strategy, which includes holding gold, silver, and Bitcoin as protection against a potential monetary crisis. He contends that the global economy's reliance on money printing to remain solvent is untenable and will ultimately lead to the collapse of fiat currencies. The recent inflationary pressures and mounting concerns over the pandemic's economic effects have driven demand for alternative assets such as gold, silver, and Bitcoin.

Market Trends and Future Outlook

As Bitcoin lingers near the crucial $30,000 resistance level, investors and traders are keeping a close eye on market trends. A breakout above this threshold could indicate a resurgence in bullish momentum, possibly leading to a retest of the all-time high at $64,000. Conversely, failing to surpass it may result in a period of consolidation or a potential downtrend. The upcoming trading sessions will be critical in shaping Bitcoin's short-term future, so market participants should exercise caution and closely monitor price movements.

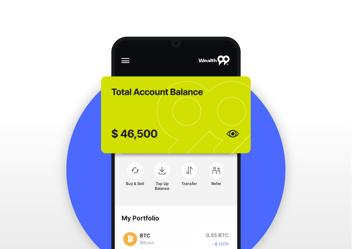

Wealth99: Investing in Crypto and Tokenized Precious Metals

With the growing interest in alternative assets, the Wealth99 platform offers investors the opportunity to safely and simply invest in cryptocurrencies like Bitcoin, as well as tokenized precious metals. Take advantage of the platform to diversify your investments and navigate the crypto market with confidence. Additionally, don't miss our latest podcast featuring Dave the Wave discussing Bitcoin's future prospects and insights on the cryptocurrency market.

DISCLAIMER: The information on this website is provided as general market commentary and does not constitute investment advice. We encourage you to conduct your own research before investing.

.svg)

.svg)

.svg)