What are alternative assets?

Alternative assets are the new generation of investment opportunities – like crypto, digital assets, and tokenized assets. In a world where traditional assets aren’t performing like they used to, alternative assets can offer better returns, more diversified portfolios, greater tax benefits, and higher liquidity. Making them a vital part of any forward-thinking investor’s portfolio.

“40% of investors plan to shift hedge fund assets to alternative asset classes.”

EY.com

What is asset tokenization?

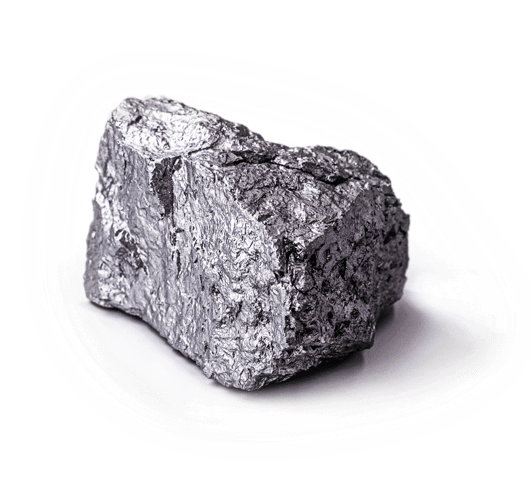

Asset tokenization is the process of creating digital versions of real-world assets. Powered by blockchain technology, tokenization allows for fractional ownership of assets. In doing so, it’s democratizing wealth for the 99%. And unlocking investment opportunities that were one reserved for the financial elite.

At Wealth99, we’re pioneers in the field of tokenization. We were among the first in the world to create tokenized precious metals. Removing the logistical barriers to purchasing physical metals, and giving everyday people the opportunity to quickly and easily invest in gold, silver, and platinum.

Alternative assets are the future of investing

The alternative asset market is expected to grow to $17trillion by 2025. There’s no doubt this new asset class is a compelling way for everyday people – the 99% – to take control of their financial future.

The only issue is figuring out how.

As with all things ‘new’, ‘emerging’, or ‘alternative’, awareness and education are critical. That’s what Wealth99 is here for. We provide everyday people and financial advisers with the support, resources, and knowledge needed to unlock the potential of alternative assets.

From ESGs to NFTs, crypto to tokenization. This new world brings new ideas – and new complexities – with it.

As the world’s leading New Wealth platform, Wealth99 is here to help solve them.

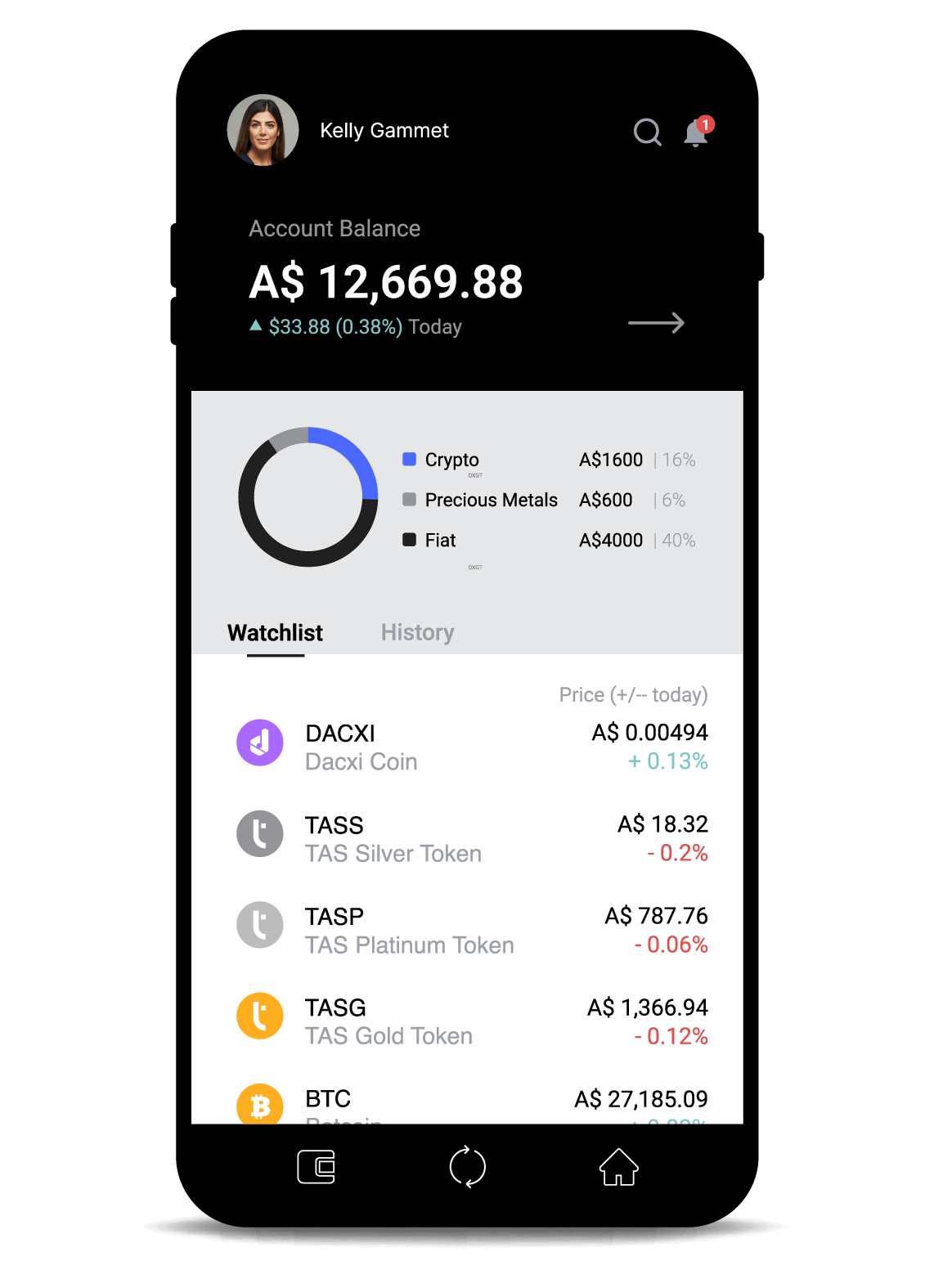

Assets

Wealth99 connects you with a range of exciting digital assets.

Carbon Credits

Buy a cleaner, greener future, with carbon impact-reducing options.

Commercial Real Estate

Claim your fractional ownership stake in real-estate.

Trump’s Trade War: What Chaos Means for Crypto and the Smart Investor

With new tariffs in play, global markets are shifting fast. For some, this signals uncertainty; for wealth investors, it...

The Blue Chip Bundle Just Got Stronger—Here’s What’s New

Crypto Isn’t Just About Hype—It’s About Staying Power Crypto isn’t just meme coins and moonshots. Smart investors know the...

New Australian Crypto Regulations: What Investors Need to Know

On March 21, the Australian Treasury unveiled its long-awaited update on the future of digital asset regulation. The...

.svg)